[SMM Hot Topic] Steel Companies' Q3 Reports Show Rising Profits, Significant Improvement for Many

In Q3, domestic economic operations were generally stable, with accelerated industrial upgrading and development of new quality productive forces. New momentum enhanced economic resilience and vitality, leading to steady growth in steel demand from sectors like high-end manufacturing and new energy. The spread between purchase and selling prices saw a slight recovery QoQ. During the reporting period, the domestic steel price index rose 1.8% QoQ from Q2; iron ore prices increased slightly, with the Platts 62% iron ore index up 4.4% QoQ from Q2. Coking coal prices rose sharply, with the Lvliang coking coal price in Shanxi increasing 17.7% QoQ from Q2. However, it is noteworthy that the steel industry remains in a pattern of strong supply and weak demand, with some enterprises still facing operational pressures such as costs being more likely to rise than fall, and transformation and upgrading.

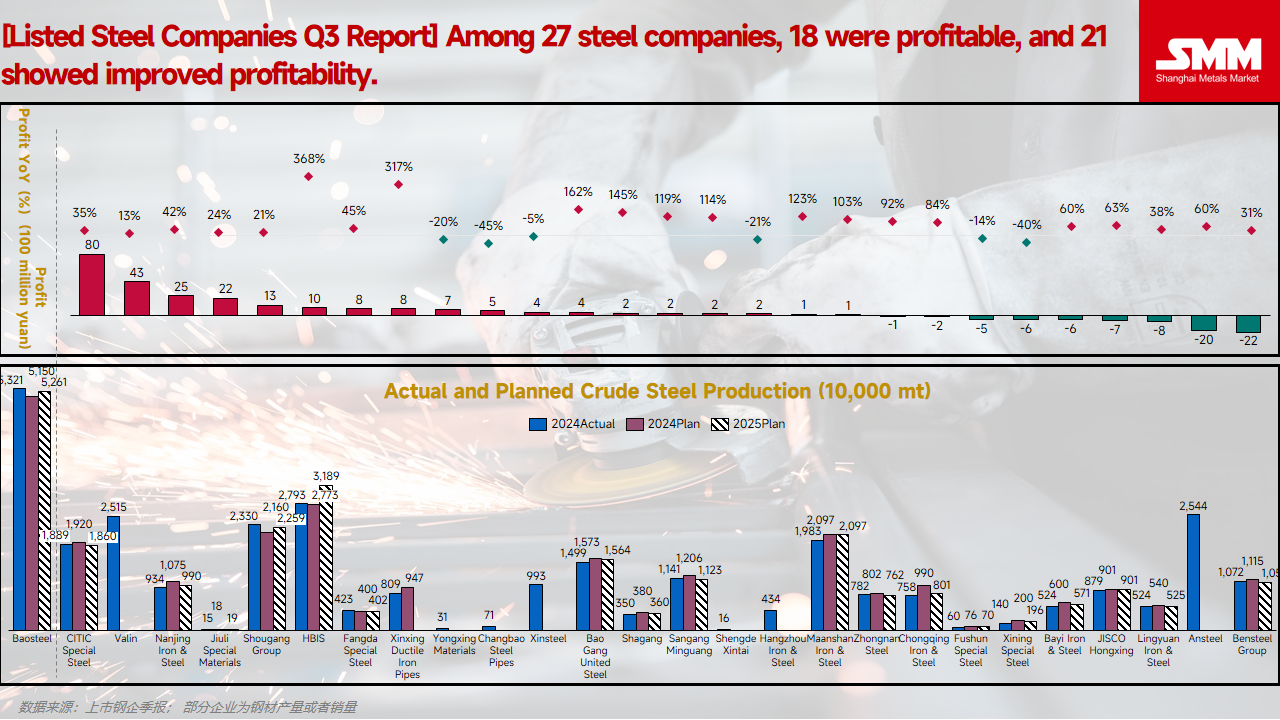

Summary of Q3 2025 Report Data from 27 Steel Companies

Based on the disclosed Q3 2025 performance reports from 27 steel companies, profitable enterprises accounted for over half. Compared with the semi-annual reports, many showed significant profit improvement. Specifically, 21 companies achieved YoY growth in net profit, while only 6 saw a decline; 18 companies reported a net profit in Q3, with 9 still in a loss position.

Among them, Fangda Special Steel, which saw rapid YoY net profit growth, stated in its Q3 report that the profit improvement was mainly due to "the decline in raw fuel costs during the reporting period being greater than the drop in steel selling prices, coupled with the company's optimization of its product mix."

Similarly, Xinyu Iron & Steel, also experiencing high growth, indicated that "the company took effective measures to improve operational performance, actively implemented cost reduction and efficiency enhancement efforts, resulting in better product gross margins compared to the same period last year."

Meanwhile, losses narrowed for Ansteel Group and Bensteel Group's sheets & plates division. Among them, Ansteel reported a loss of 2.04 billion yuan. Net losses decreased significantly, with the net loss attributable to parent shareholders narrowing to 2.04 billion yuan for the first three quarters, a 59.87% improvement YoY, indicating notably enhanced operational resilience. Operating cash flow saw a strong reversal, with a net inflow of 1.968 billion yuan in the first three quarters, surging 728.75% YoY, reflecting improved destocking and payment collection efficiency. Systematic cost reduction achieved remarkable results, lowering costs by 90 yuan per mt, which alleviated pressure on the cost side and supported profit recovery.

Bensteel Group's sheets & plates segment reported a loss of 2.216 billion yuan. Net profit improved significantly YoY, with the loss narrowing by over 30%, mainly due to the reversal of asset impairment losses and optimized cost control. In Q3 alone, the loss narrowed by 50.56% compared to the same period last year.

Looking ahead,

the core driver of profit improvement stems from effective cost control. Relevant data show that the operating costs of the ferrous metal smelting and rolling processing industry from January to September amounted to 5,445.72 billion yuan, down 6.1% YoY. The cost decline was significantly larger than the revenue decline, creating conditions for profit margin recovery. For the future development of steel enterprises, it is recommended to reduce production costs through refined management on one hand, and on the other hand, to increase the proportion of high value-added products by proactively adjusting product lines, thereby improving gross profit margins. At the same time, industry self-discipline and production restrictions can reduce low-price competition, support price stability, and expand profit margins.

Copyright and Intellectual Property Statement:

This report is independently created or compiled by SMM Information & Technology Co., Ltd. (hereinafter referred to as "SMM"), and SMM legally enjoys complete copyright and related intellectual property rights.

The copyright, trademark rights, domain name rights, commercial data information property rights, and other related intellectual property rights of all content contained in this report (including but not limited to information, articles, data, charts, pictures, audio, video, logos, advertisements, trademarks, trade names, domain names, layout designs, etc.) are owned or held by SMM or its related right holders.

The above rights are strictly protected by relevant laws and regulations of the People's Republic of China, such as the Copyright Law of the People's Republic of China, the Trademark Law of the People's Republic of China, and the Anti-Unfair Competition Law of the People's Republic of China, as well as applicable international treaties.

Without prior written authorization from SMM, no institution or individual may:

1. Use all or part of this report in any form (including but not limited to reprinting, modifying, selling, transferring, displaying, translating, compiling, disseminating);

2. Disclose the content of this report to any third party;

3. License or authorize any third party to use the content of this report;

4. For any unauthorized use, SMM will legally pursue the legal responsibilities of the infringer, demanding that they bear legal responsibilities including but not limited to contractual breach liability, returning unjust enrichment, and compensating for direct and indirect economic losses.

Data Source Statement:

(Except for publicly available information, other data in this report are derived from publicly available information (including but not limited to industry news, seminars, exhibitions, corporate financial reports, brokerage reports, data from the National Bureau of Statistics, customs import and export data, various data published by major associations and institutions, etc.), market exchanges, and comprehensive analysis and reasonable inferences made by the research team based on SMM's internal database models. This information is for reference only and does not constitute decision-making advice.

SMM reserves the final interpretation right of the terms in this statement and the right to adjust and modify the content of the statement according to actual circumstances.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)